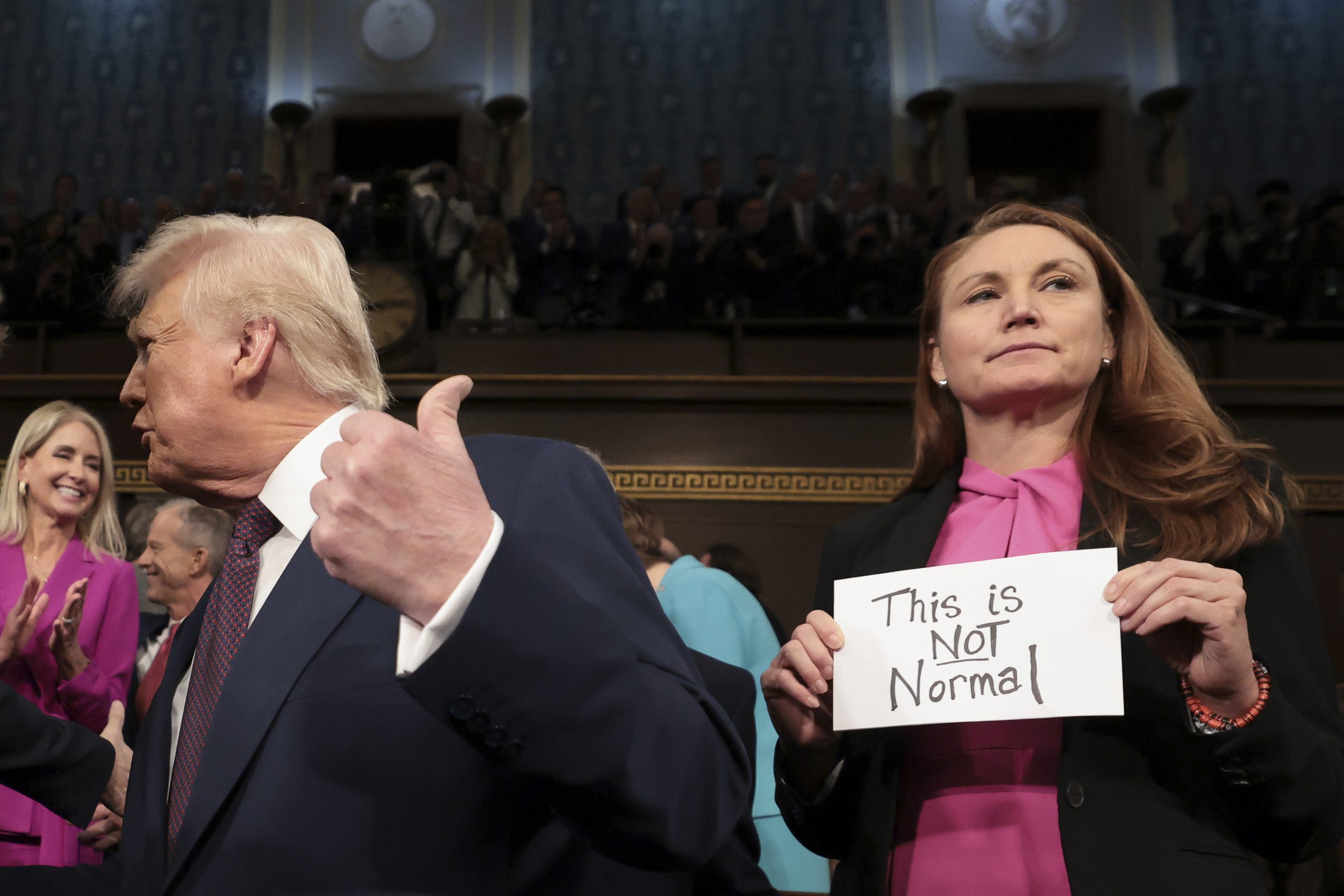

It was perhaps the understatement of the modern era when Melanie Stansbury, a U.S. House Democrat, held up a sign that read “This is not normal” as U.S. President Donald Trump made his triumphant return to the U.S. Capital that was attacked by his supporters after he falsely claimed the 2020 election was stolen by anti-American woke forces.

After all, despite Trump’s undisputed election victory last year, it isn’t normal for the so-called leader of the free world to be a twice-impeached pathological liar, not to mention a convicted felon. And then there is the abnormal Trumptopian vision for a new American golden age driven by treating friends worse than enemies while repeatedly threatening, deploying, and then delaying prosperity-killing tariffs like never before.

As Zanny Minton Beddoes, editor of The Economist, recently wrote, “So head-spinning is the world-changing nature of decisions from the White House at the moment that it is sometimes hard to believe this is all actually happening. Had someone said to me a few weeks ago that President Donald Trump would throw Volodymyr Zelensky out of the White House, cut off intelligence support and military assistance to Ukraine and impose 25% tariffs on both Mexico and Canada, before announcing delays and exemptions—all within one week—I would have struggled to believe them.”

But it is happening. The “not normal” is the new normal, at least for now.

In an earlier IBJ feature (see “The Art of Dealing with Trumpian Threats and Theatrics”), this publication argued that Canadian policymakers should keep their powder dry until it is clearly time to drop the gloves. Unfortunately, Trump keeps dropping his gloves and picking them up, while trash talking about leading a hostile takeover of Canada. And whether you believe he is secretly a Russian asset or genuinely thinking he is serving American interests or simply trying to keep people distracted while using the power of the Oval Office to pump his family’s crypto ventures, trying to figure out what comes next is a mug’s game.

The current U.S. administration is “predictably unpredictable,” says Ivey Business School professor Mary Crossan, adding that behavioural forecasting based upon character analysis suggests this isn’t going to change. For Canadian policymakers that means focusing on backchannels and reaching out to influential Americans with balanced character when trying to make the case for maintaining free trade. For Canadian business leaders, it means agility and scenario planning are more important than ever before. As noted by Ivey professor Romel Mostafa, director of the Lawrence National Centre for Policy and Management, Canadian firms need to be laser focused on “things they can control,” including strategies to reduce exposure to the U.S. market and improve innovation and productivity.

These were key takeaways on March 6, when Ivey Dean Julian Birkinshaw moderated an online discussion that explored how Canadian business leaders and policymakers should respond to erratic U.S. policy (a recording of Ivey’s event entitled “Trade on trial: What’s at stake for Canadian business” is available here).

Washington’s developing psychodrama

Believe it or not, President Trump touted the existing North American trilateral trade deal that replaced NAFTA during his first term as a major U.S. victory. Nevertheless, he returned to the White House threatening to immediately punish Canada and Mexico with sweeping tariffs—his favourite weapon of mass economic destruction—for supposedly being ungrateful neighbours who are ripping America off by running trade surpluses with the world’s largest economy while also allowing a flood of fentanyl and illegal migrants cross their borders into the United States.

On Inauguration Day in late January, the threatened tariffs failed to appear. But shortly after, Trump signed an executive order to impose 25 per cent tariffs on imports from Canada and Mexico in early February (the levy on energy was set at 10 per cent). In response, Canada threatened to initiate countermeasure targeting imported U.S. goods worth $30 billion. Canada also promised it would up the ante to target $155 billion worth of U.S. imports if necessary. Trump’s tariffs were then delayed for 30 days as Canada and Mexico moved to address border concerns. But on March 4, despite forcing border security improvements, Trump’s tariffs went into effect.

On March 5, Trump issued a temporary 30-day reprieve for the auto sector. Nevertheless, after months of uncertainty, it looked like Trump wasn’t bluffing. But ironically, as Birkinshaw was noting the fluidity of Washington’s baffling trade policy at the Ivey event the next day, the U.S. president suddenly announced Mexico would receive another one-month reprieve. The accommodation was attributed to respect for Mexican President Claudia Sheinbaum. This seemed to indicate that Trump’s distaste for Canada’s Liberal leadership was going to ensure sweeping tariffs on goods from the Great White North would remain in place. But by the end of the day, Canada was also granted a second stay on the execution of tariffs, at least for goods covered by the existing North American free trade agreement.

At press time, amid market turmoil, the Trump administration was still threatening to decimate Canadian industry with blanket tariffs along with additional reciprocal duties on targeted goods. Steep tariffs on everything from steel to dairy products could already be in place by the time this article is published. But given the flipflopping, nobody really knows what to expect over the short, medium, or long term.

As a tax on imported goods, tariffs date back to at least the fourth millennium BCE, when they were applied to metal and wool being exchanged between the ancient cities of Kanesh and Assyria located in what are now Turkey and Iraq, respectively, according to a Tax Foundation history brief. Over the years, they have been imposed at various levels to generate revenue for various nations with various outcomes. But they are a double-edged sword because while they generate revenue, they can also stifle economic activity. To be effective, tariffs need to be applied strategically and surgically.

Trump wasn’t shy about threatening tariffs in his first term, but when deploying them he was relatively constrained. Today, he is unchained, and when it comes to the tariff plans and targets of his second administration, as former U.S. trade official Jonathan Doh recently told The New York Times DealBook newsletter, there doesn’t seem to be any “clear long-term strategy or end game.” Indeed, the only thing that seems clear (at least to anyone who knows the facts) is that the White House is seriously misleading Americans when claiming Canada is flooding their homeland with fentanyl and illegal immigration. That’s seemingly just a ruse to bypass Congress and justify using emergency powers to bully historical allies.

Simply put, Trump started his second term looking like an immature kid tossing firecrackers into a retirement home simply to watch vulnerable people jump. But while he could just be feeding his ego by using his power to create chaos, there could also be a method to his trade policy madness. Indeed, his actions might make sense if he is really just looking to cut a new North American trade deal or is serious about forcing a takeover of Canada.

Whatever the case, whether Trump understands the risks he is taking with the global economy remains an open question—one that might be moot because the wellbeing of others doesn’t seem to factor into his thinking. The cautionary lessons of America’s tariff history, if he knows them, certainly appear to interest him less than the students sleeping through a lecture on the Smoot-Hawley Tariff Act in the movie Ferris Bueller’s Day Off. Enacted during the Hoover administration in the wake of the 1929 market collapse, Smoot-Hawley spawned (anyone, anyone) a costly global trade war credited with worsening the Great Depression and setting the stage for the Second World War.

As DealBook notes, trying to read the tea leaves is further complicated by the seemingly polar opposite views of key White House advisors on the U.S. trade file: “There’s Howard Lutnick, the former head of Cantor Fitzgerald who is a moderate on trade and now commerce secretary. And there is Peter Navarro, a longtime Trump lieutenant and a proponent of high tariffs who is generally opposed to trade deals.”

Lutnick is credited with helping U.S. automakers obtain their one-month carve-out from blanket tariffs before the blanket was put back in the closet on March 6. As a result, DealBook advises business leaders to pay attention to who in Trump’s orbit is “making the media rounds” as what Canadian Foreign Affairs Minister Mélanie Joly calls America’s “psychodrama” plays out. How much influence anyone has on Trump’s decision making, of course, is another open question. After all, he isn’t known to listen to others (or at least not others who disagree with his ideas). Meanwhile, the dynamics of his inner circle can change at any given moment for reasons that can defy logic.

That said, while Trump claims he is prepared to ignore the reaction of investors, he has traditionally been sensitive to market turmoil, and major stock indexes have signalled significant displeasure with his on-again, off-again trade war. Trump also campaigned on “making America affordable again.” And while his tariffs will give some businesses an incentive to make more things in the United States, it is because they make foreign goods less competitive in the world’s largest economy by making them more expensive to purchase.

If tariffs are imposed as Trump currently insists, economist David Rosenberg argues American households will soon “no longer be blaming Joe Biden for an inflation breakout, especially for goods that are essentials. They will be blaming the current President.”

Maybe. Maybe not. As Rosenberg notes, the impact of Trump’s first-term tariffs on real take-home pay in America was offset by tax relief that came first, and those tariffs were more targeted and less radical in terms of size. Tax cuts are on the second-term Trump agenda, but this time they are behind tariffs, so the pain won’t be muted. And yet Trump could shift the blame.

As an economist, Rosenberg can see why the United States isn’t being ripped off by running trade deficits while also having a capital account surplus, but consumers on both sides of the border have little understanding of (anyone, anyone) balance-of-payments accounting. And while Canadian officials are trying to educate U.S. voters on the folly of paying dearly to support an unjustified trade war with a formerly trusted ally, misinformation abounds. In one social media post on X, Canada was actually billed as a dirty economic partner threatening to nuke the United States with weapons borrowed from Europe.

In this environment, while U.S. CEOs are reportedly pleading for a more predictable tariff agenda, it is impossible to predict how Americans will react to a trade war. Canadian countermeasures could backfire by rallying support for Trump’s trade war, especially if we follow proposals to starve Americans of everything from energy to toilet paper. They might even be used to justify Trump’s tax cut plans.

Consider what happened after Ontario Premier Doug Ford placed a 25 per cent surcharge on electricity exports to the United States, which increased the risk of power brownouts across the continent while threatening to raise costs for over a million households in Michigan, Minnesota, and New York. Within a day, Trump forced Ontario to back down by insisting he would double down on his tariff plans for steel and aluminum. While repeating his threat to takeover our country, he also issued a social media post that read: “Can you imagine Canada stooping so low as to use ELECTRICITY, that so affects the life of innocent people, as a bargaining chip and threat? They will pay a financial price for this so big that it will be read about in History Books for many years to come!”

Meanwhile, it is also impossible to judge how Canadians will react to countermeasures. As things stand, the majority of Canadians appear ready to accept the need for some sacrifice. But support for federal and provincial policies that drive up local prices and arbitrarily erase some marketplace options could quickly decline—and not just among local libertarians and bourbon fans.

That said, Trump’s trade war with Canada and Mexico could turn out mild or even end before it gets really nasty. In an opinion piece published by the Lawrence National Centre for Policy and Management, Ivey professor Christian Dippel outlined numerous reasons for why he thinks U.S.–Canada relations are likely to normalize sooner than expected. Among other things, he notes trade-relations with China “are the real prize for the Trump administration, and his foreign policy advisors will view Canada as an important ally in going after this prize, more so given the prospect of a different Canadian government a few months from now.”

Former U.S. House Speaker Paul Ryan also thinks trade war concerns are being overblown. He argues Trump is merely seeking an upper hand prior to a renegotiation of the United States–Mexico–Canada Agreement. “I do think we will have a USMCA at the end of these four years,” he said in a recent Globe and Mail interview, adding that he also expects to see Trump kept in check by a U.S. Supreme Court that he stocked with Federalist Society constitutionalists during his first term.

As for Trump’s threats to force the annexation of Canada, Ryan says they are nothing more than a “troll” aimed at outgoing Canadian Prime Minister Justin Trudeau.

[pullquote align=”left”] “Trump wants a total collapse of the Canadian economy, because that’ll make it easier to annex us.” [/pullquote]

Trudeau, of course, disagrees with this assessment. During his waning days in office, when Trump first started calling him “governor” of America’s 51st state, the Canadian politician initially thought Trump was just being Trump. But leading up to the recent Liberal Party of Canada vote to replace him with former Bank of Canada governor Mark Carney, Trudeau became convinced the U.S. president is seriously trying to orchestrate “a total collapse of the Canadian economy, because that’ll make it easier to annex us.”

This fits with what influential U.S. money manager David Kotok says in a commentary on his takeaways from Trump’s infamous Oval Office meeting with Zelensky. According to Kotok, the world witnessed the realpolitik mindset that has overtaken American foreign policy. “In the Oval shootout,” he says, “we witnessed a 7-minute, one-act play about the clash between power on the one hand and a discussion about right versus wrong on the other.” In other words, while the Ukrainian president remains focused on fighting deadly Russian aggression, the world’s former police officer has shifted its focus to using Ukraine’s misfortune to try to gain control of the nation’s mineral rights.

According to Carney’s victory speech, Canadians need to be ready for a real economic fight because “Americans want our resources, our water, our land, our country.” Given the nature of politics, cynics might suspect Liberals are leaning into Trump’s trolling, hoping to improve their chances in the upcoming election. But earlier this year, Trump reportedly told Trudeau that he did not accept the legitimacy of the 1908 treaty that established our border with the United States. He also reportedly said he wants to revisit the shared control of the Great Lakes.

This, of course, could be true and still be just negotiating bluster at the same time. But Canada clearly has resources that make it an attractive takeover target in a might-is-right world. And it isn’t reassuring when U.S. Democrats see the need for a No Invading Allies Act, proposed legislation to prohibit Trump from invading Greenland, Canada, or Panama without a vote of Congress.

So unfortunately, as Ivey professor Andreas Schotter put it during the Ivey event on March 6, Canadian managers need to get “comfortable with being uncomfortable,” while taking real steps to build the agility required to survive and hopefully thrive in the new normal, which is “a white water that is constant.” The opportunities of globalization still exist and should be pursued, Schotter stressed, but businesses need to be able to pivot to reap the rewards of international trade.

Hope for the best, plan for the worst

How uncomfortable could things get if exporters are hammered by a trade war and the impact spills over to the service sector while increasing costs for consumers? Bank of Canada governor Tiff Macklem has warned the economic consequences of a protracted conflict with our largest trading partner would be severe. “In the pandemic,” Macklem noted during a recent speech to the business community, “we had a steep recession followed by a rapid recovery as the economy reopened. This time, if tariffs are long-lasting and broad-based, there won’t be a bounce-back. It’s more than a shock—it’s a structural change.”

As Schotter pointed out in the Ivey publication Impact, sweeping trade threats often give way to more targeted and limited measures. But even a much smaller blanket tariff of just 10 per cent could trigger a Canadian GDP contraction of 2.4 per cent, while putting 500,000 jobs at risk. In a 25 per cent tariff scenario, job losses could triple to 1.5 million as businesses face “severe supply chain disruption, permanent structural changes, and a GDP contraction significantly exceeding 2.4 per cent. This would require aggressive monetary policy intervention, which in turn will put higher inflation on Canadians.”

Rosenberg warns Canadians to prepare for an economic shock of historic proportions. He advises planning for “a 62.5 cent (U.S.) Canadian dollar, a 1.5% policy rate, and a 2.5% yield on the 10-year GoC bond as the fallout from any 25% Trump-induced tariff on America’s so-called ‘friend’ north of the border. And focus your TSX exposure on the ‘bonds in drag’ (Banks, REITs, Communication Services, and Utilities) and the beneficiaries of a weaker dollar (Travel/Tourism) and avoid the areas that are the most affected by the Trump trade action (Industrials, Materials, and consumer products).”

In a worse-case scenario, Mostafa says the Bank of Canada could find it difficult to address a combination of rising prices and weakening economic activity with monetary policy. That means whoever is Canadian prime minister after the upcoming election could need to deliver a significant fiscal response while also helping businesses reach new markets, working with provinces to eliminate internal trade barriers, increasing defence spending, and managing debt.

In an Impact blog on policymaking, Mostafa noted there are obvious ways for Canadian politicians to improve our nation’s competitive advantage, including “streamlining natural resource permitting and enabling critical trade infrastructure to be built, developing smart and more agile regulation, eliminating interprovincial trade barriers, reducing government spending while prioritizing productivity-enhancing investments, and fully leveraging our other trade agreements while supporting product placement in international markets.”

But while federal and provincial governments can help business leaders mitigate the impact of Trump’s tariffs, Canadian firms will still need to proactively help themselves if they want to successfully navigate a prolonged trade war. Schotter advises Canadian companies to identify risks and prepare for potential disruptions by conducting a thorough supply chain assessment while planning for both 10 per cent and 25 per cent tariff scenarios. He also advises building at least six months of cash reserves and reviewing existing contracts with a view to renegotiating tariff provisions and limiting financial exposure.

“Beyond these immediate defenses,” Schotter told Impact, “companies should focus on strategic transformation. Reducing cross-border dependencies with vertical integration and building strong domestic supplier networks can ensure long-term stability. Embracing digital tools and advanced inventory management, like AI, can also boost competitiveness and efficiency. Lastly, pursuing strategic partnerships or mergers can provide the scale and strength needed to thrive in what will be a very challenging economic climate.”

Ivey’s Crossan advises Canadian leaders to remember a key lesson from earlier crises, meaning the importance of character. She notes elevating character alongside competence in hiring, promoting, and leadership development improves performance through improved decision making, which offers a competitive advantage in good times and bad.

As Ivey Dean Birkinshaw pointed out in a recent blog, “it is often said that the best way to respond to a crisis is to frame it as both threat and opportunity.” With this in mind, the chaos created by the Trump administration should be seen as an opportunity to finally address our national complacency surrounding innovation, productivity, and overexposure to the U.S. market.

Given what is happening next door with regards to foreign policy, DEI and market regulation, there is also an opportunity to loudly position our nation as a more trustworthy, stable, and stakeholder-friendly trading partner, not to mention a great place to invest and conduct business. Indeed, as Ivey’s Mostafa noted on March 6, “there is a reason why Donald Trump sees value in Canada,” where our educated workforce is as attractive as our resources.

Birkinshaw ended the Ivey discussion on navigating a trade war by highlighting The Economist’s Footloose Index, which uses Gallup surveys to rank the top dream destination of university graduates. Canada currently tops the list.

So, keep our stellar brand in mind as the Washington-sponsored psychodrama plays out, and let’s start calling Trump the governor of Canadian reinvention.

Thomas Watson (Twitter: @NotSocrates) is a veteran business journalist, management consultant and communications professional with experience spanning executive education, thought leadership development, institutional storytelling, strategic communications, public and investor relations, and media production. As a Financial Post Magazine columnist and Editor-in-chief of Ivey Business Journal—one of Canada’s oldest business publications published by the prestigious Ivey Business School at Western University—Watson is recognized as an expert commentator on topics ranging from leadership and governance to managing disruption and the evolution of capitalism.

At Ivey, in addition to managing IBJ, Watson helps promote best practices in management by developing custom case studies and executive development programs. As a guest lecturer, he also shares his experience as a young VC executive who risked his career and reputation to expose the stock manipulation of a Canadian tech market darling during the dotcom boom. Watson’s insider account of this mind-blowing international scheme was featured by Canadian Business as a cover story in 2002. Entitled “The Man Who Ambushed Open Text: And How I Helped Him Do It,” Watson’s first long-form magazine article garnered comparisons to Liar’s Poker by financial journalist Michael Lewis. This led to an award-winning investigative reporting career. Highlights include: “Abandoned at the Altar,” an exclusive account of why Bay Street’s GMP Capital got cold feet when helping Ashley Madison’s corporate parent go public in 2010; “Shell Games,” an exposé of criminal boiler rooms that financed the Canadian expansion of Ben & Jerry’s during the 2008 financial crisis; “ABCP: Hunter and the Hunted,” a profile of the retail market rebellion sparked by Bay Street’s unethical marketing of high-risk asset-backed commercial paper; “The Trials and Tribulations of Brian Hunter,” an exclusive account of the 2006 implosion of the Amaranth Advisers hedge fund; and “An Apology for Eleanor Clitheroe,” a profile of the sexism and hypocrisy that derailed Hydro One’s attempt to go public with a female CEO in 2002.

Watson holds undergraduate degrees in history and political philosophy. As a graduate student, he studied journalism, political theory, international politics, public finance, and macroeconomics. Post-graduate studies included securities and market regulation.