Not that long before Chrysler’s shot-gun wedding to Fiat in 2009, the smallest member of Detroit’s not-so-big-anymore Big Three automakers was hitched to Daimler-Benz. When that relationship turned rocky in 2000, a German auto executive named Dieter Zetsche was exported to the United States to take the wheel from a local industry boy named James Holden. With his wooden personality and walrus mustache, Zetsche initially came across like an executive version of Pinocchio’s papa. But it soon became clear that he was a skilled corporate axe man with firm orders from Stuttgart to straighten out the American company. After the so-called “merger of equals” became more of a foreign invasion, many Holden loyalists who were not fired started to jump ship and Chrysler’s morale soon matched its fiscal health.

But Zetsche eventually managed to do an impressive job at winning over Chrysler’s remaining managers, not to mention members of the North American media, despite the fact that he slashed 26,000 jobs and ordered the closure of six factories just months after taking charge. Part of Zetsche’s early success was the result of smart PR moves. As a tribute to the heroes of 9/11, for example, he had the company restore an old fire hall, and make it into a bar that doubled as a posh press club — with no cash registers — during the influential Detroit auto show. And the taps at this media watering hole were operated by senior company executives, giving even the most ethical of journalists an excuse to accept free beer.

As a barkeeper, Zetsche charmed American and Canadian reporters alike. Unfortunately, his COO at the time — another imported German executive named Wolfgang Bernhard — was not as smooth as his folksy boss. Indeed, shortly after the Chrysler bar opened, Bernhard made a point of scolding an American executive for serving beer with too much foam. Then after loudly apologizing for the lack of quality control, he personally created a production line of perfectly poured brews. As I reported in Canadian Business magazine, he then announced: “That’s how Daimler will save this company from the Yanks.” After raising American journalistic eyebrows with that comment, Bernhard joked about turning a threatened Windsor auto plant into another Chrysler-branded bar. But Canadian reporters forgot about that insult when Bernhard later told me at the 2003 Detroit auto show that our nation had no choice but to pay for future manufacturing investments. “When I go to Mexico,” he said, “I get some government support in 30 seconds. Why would I go to Canada without getting government support?”

Bernhard’s blunt comments were reprinted in both of Canada’s national newspapers, where they didn’t sit well with Ontario’s Conservative government or our nation’s anti-subsidy crowd, which considers requests for investment incentives nothing short of corporate blackmail. Walter Robinson, Federal Director of the Canadian Taxpayers Federation at the time, bemoaned Chrysler’s expectations of government support, asking what the automaker would demand next: “a minister of minivans?” But while nobody picked up on it back then, Bernhard actually posed a relatively fair question, one that is even more relevant today.

As Ivey Business School professor Paul Boothe noted in Maclean’s magazine earlier this year, the competition for manufacturing investments has never been fiercer thanks to explosive trade growth driven by the rise of global value chains, not to mention growth in emerging economies, which has created unprecedented growth in global goods consumption and production. But when it comes to attracting investments to service this explosion in trade, Canada is a laggard despite being a trading nation with all the talent and tools required. Why? According to Boothe, who heads Ivey’s Lawrence National Centre for Policy and Management, a superficial analysis might lay most of the blame on our nation’s labour costs and the level of government incentives offered to support manufacturing investments. But the reality of the situation is far more complex. In fact, if you look at the big picture, Lawrence Centre research shows that investment incentives and labour costs are not Canada’s major concern. The big issue is the fact that nobody in Canada has ever really seriously tried to effectively answer the all-important why-invest-in-Canada question.

Demands for taxpayer assistance have never been unique to the auto sector, nor Chrysler, where they were part of the game long before the Germans invaded Detroit. Incentives were expected under Holden, who — for the record — was a Canadian, not an American, which is why Zetsche found a maple leaf on the flag hanging behind his desk when he took hold of the Chrysler steering wheel. Government assistance was also expected by Tom LaSorda, another Canuck, who took over as Chrysler CEO when Zetsche returned to Germany to run Daimler in 2005. And government incentives are expected today by Sergio Marchionne, the Italian-Canadian CEO who has run Chrysler since Fiat started its repair job on the company. Simply put, despite the revolving door at Chrysler HQ, one thing inside the corner office has never changed: Canadian operations do not rate special treatment. With or without Canadians at the helm, investment decisions made in Detroit are not influenced by any special love for the Great White North. They are based upon business cases, which are influenced by numerous factors, not just local government support.

Canadian opposition to offering incentives, of course, has wavered somewhat since Bernhard enraged the Canadian Taxpayers Federation, and not just because of Ontario’s return to Liberal leadership. As a 2003 Globe and Mail editorial noted:

While doing so goes against our anti-subsidy principles, there is an argument to be made that Ontario can’t afford to be left out again when it comes to new auto industry investment. The luring of new car plants has become a high-stakes game of financial chicken, with different regions scrambling to offer the most attractive package of tax breaks, infrastructure spending, research and development grants and plain hard cash without bankrupting themselves in the process. So far, southern U.S. states and Mexico have been winning the game. Over the past 13 years, seven new plants have been built in the United States and another six in Mexico. The number of new plants built in Ontario? One, by Honda.

Jump ahead to 2016 and the argument for playing the incentive game appears even stronger. After all, while Canadian auto-sector investment was worth US$1.5 billion last year, twice 2014 levels, not one of three new assembly plants announced for North America will land in Canada. Meanwhile, the United States attracted US$29 billion in new sector spending last year, including two new assembly operations. And while total auto investments in Mexico actually dropped to US$4.5 billion last year, down from US$7 billion in 2014, the nation still won its eighth new assembly plant since 2010. And as Globe and Mail reporter Greg Keenan noted, with the greenfield plants currently under construction elsewhere and the North American market expected to soon hit a post-Great Recession peak, Canada could end up being bypassed for new plant investments for an entire investment cycle.

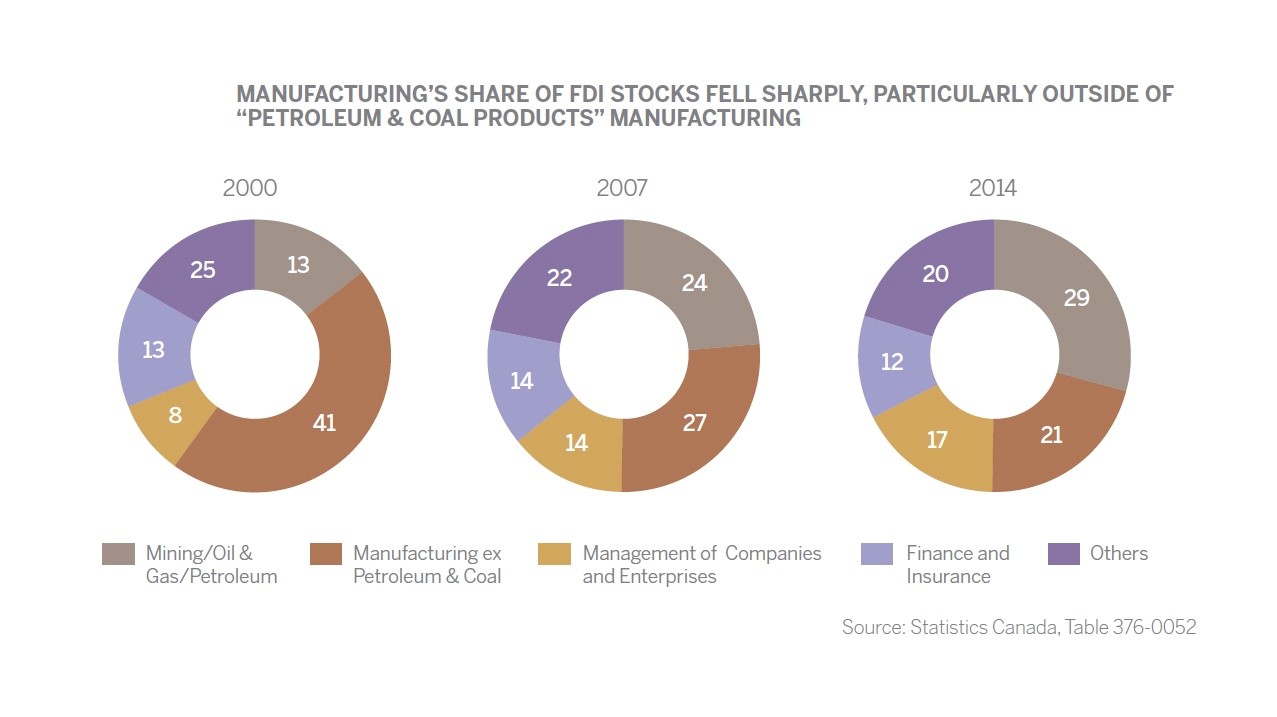

But Canada is not just losing the competition for new auto plants. If you just quickly look at the numbers, the Canadian economy still attracts a reasonable share of foreign direct investment: However, as highlighted by a recent study of aggregate FDI numbers by Lawrence Centre researchers David Moloney and Sandra Octaviani, there has been a significant shift in the industrial composition of Canadian FDI inflows over the past 15 years. Over that period, the Canadian stock of oil and gas FDI has grown four-fold, while there has only been modest growth in manufacturing investments.

However, as highlighted by a recent study of aggregate FDI numbers by Lawrence Centre researchers David Moloney and Sandra Octaviani, there has been a significant shift in the industrial composition of Canadian FDI inflows over the past 15 years. Over that period, the Canadian stock of oil and gas FDI has grown four-fold, while there has only been modest growth in manufacturing investments. The FDI picture looks even more troubling when you look at greenfield projects. In the past decade, Canada has seen a 100 per cent increase in announced FDI for greenfield operations, but announced investment growth for new manufacturing plants in the United States has been at least three times the Canadian level. Meanwhile, the value of announced FDI for Mexican greenfield projects has jumped from roughly half the Canadian value to almost double over the same timeframe.

The FDI picture looks even more troubling when you look at greenfield projects. In the past decade, Canada has seen a 100 per cent increase in announced FDI for greenfield operations, but announced investment growth for new manufacturing plants in the United States has been at least three times the Canadian level. Meanwhile, the value of announced FDI for Mexican greenfield projects has jumped from roughly half the Canadian value to almost double over the same timeframe.

As a result of this weak performance, even many die-hard free marketers now accept the need to play the incentive game. In fact, the incentive debate has shifted from whether or not to offer any financial support at all to how incentives should be offered. As The Globe and Mail reported in mid-August, the Automotive Parts Manufacturers’ Association of Canada along with vehicle manufacturers are now calling for a revamping of the Automotive Innovation Fund, arguing it needs to start offering car companies grants instead of taxable loans in order to be effective in a low-interest-rate environment. But the ongoing focus on incentives actually hides a bigger issue because Canada’s lackluster FDI performance doesn’t just warrant a discussion about revamping how we offer government support. Indeed, as Moloney and Octaviani concluded, it calls for a serious review of Canada’s whole approach to attracting investment.

With this objective in mind, the two Lawrence Centre researchers examined the approaches of foreign investment attraction organizations such as SelectUSA, InvestHK, and ProMéxico, which are widely respected for strengthening the international trade and investment performance of their respective homelands. What did they find? Simply put, in the words of Moloney, “Canada’s approach to FDI attraction today falls well short of ensuring that reliable, timely and tailored information on key investment decision parameters is both widely available and communicated to targeted decision-makers as part of coordinated, ongoing strategic engagements, and that organized, end-to-end assistance is proactively provided throughout prospective investors’ processes of due diligence, approvals and applications.”

The two studies conducted by Moloney and Octaviani were part of “Attracting Global Mandates,” the second phase in a body of Lawrence Centre research that deployed Ivey’s case method to examine the current state of Canadian manufacturing and consider what manufacturers need to do to thrive in an increasingly competitive global economy. Entitled “Learning from Leading Firms,” Phase 1 examined the strategies deployed by nine internationally successful Canadian manufacturers and the supporting roles played by governments. In addition to Canadian FDI performance and international best practices in investment attraction, Phase 2 included the following studies: “A Framework for Understanding Investment Attraction,” “Core Manufacturing,” and “Food and Industrial Biotechnology.”

Both Phase 1 and Phase 2 of this project were supported by the Canadian Council of Chief Executives, the Canadian Imperial Bank of Commerce, IBM, Industry Canada, and the Ontario Ministry of Economic Development, Employment and Infrastructure. Working with these partners and other stakeholders, the Lawrence Centre developed the following three overarching practical recommendations to help Canada raise its investment attraction game to the level of its best-practice competitors:

- Since the lack of coordination between federal, provincial and municipal governments is an obvious departure from best practice and makes Canada appear disorganized and disinterested, all governments involved should make a formal commitment to act in a coordinated fashion when engaged in investment attraction.

- Since the lack of clear objectives, explicit actions and accountability for results is another departure from best practice, government players should jointly develop an explicit business plan for investment attraction to guide all relevant parties with results judged using a simple metric: incremental tax revenue generated.

- Canadian political leaders and senior government officials should become engaged in a regular and sustained way in all stages of the investment attraction process. As in best-practice jurisdictions, Prime Ministers, Premiers and Economic Development Ministers should include regular contact with potential investors and the opening of new markets as one of their key responsibilities.

Simply put, the Lawrence Centre research calls for Canada to better coordinate the efforts of provinces, municipalities, and the federal government so that our nation can provide one-window investment attraction services that highlight our strengths and offer detailed knowledge of coming opportunities. While the amount of our financial support was seen as broadly competitive, there is a need to simplify the related terms and conditions while speeding up the process so it operates in private-sector timeframes rather than those of public-sector processes. And if Canada adopts the above recommendations and spends the time and energy required to put our best foot forward, we can effectively answer the all-important question posed in 2003 by Bernhard (whose career has since required frequent restructurings of its own).

Keep in mind that all Daimler’s blunt former crown prince wanted to know as Chrysler’s COO years ago was why anyone would invest in Canada without getting government support. And he represented a company already heavily invested in Canada. Today, we may indeed have no choice when it comes to offering government support. But the bigger concern should still be that even when Canada plays the incentive game, takers are now few and far between. As Chrysler’s current leadership pointed out in 2014 when seeking taxpayer support for investing in Canadian operations, Canada had attracted only $2.2 billion of $42 billion worth of automotive investments made in North America over the previous five years. And believe it or not, virtually all of the automotive companies who invested more than $40 billion in Mexico and the United States in that period “never even bothered to ask Canada if it was interested in helping to bring these investments and jobs to Canada.”

Canada can’t afford to fly under anyone’s manufacturing investment radar, so as Boothe noted in Maclean’s, it is clearly time for our politicians and industry leaders to jointly follow the lead of Canada’s world-class athletes and set our sights on “owning the podium” in investment attraction by learning from our top competitors. Looking at Canada’s performance in Rio, Globe and Mail sports writer Cathal Kelly recently noted our athletes just proved that in order to claim an overall win in Olympian competitions, “prizes must be combined with a larger sense that we showed well.” When it comes to the competition for FDI, we need to be able to say the same.

I simply could not depart your web site prior to susgtgeing that I really enjoyed the standard info an individual supply to your guests? Is going to be back frequently in order to inspect new posts