The literature on innovation in business is extensive—but not just because of its importance. The significant attention innovation attracts stems partly from the fact that most organizations struggle to successfully do it. And when it comes to offering actionable advice on how to innovate efficiently and consistently, the existing literature often misses the mark, overly focusing on high-profile successes and the process of innovation while emphasizing transformation via technology.

This is understandable, especially in the digital age. But to improve how organizations develop and commercialize innovation, our experience has led us to conclude that much more attention needs to be paid to the primary role played by human beings along with the importance of applying general principles—such as learning from failure and being open to collaborating with competitors.

Over the past several years, we have conducted in-depth research on innovation effectiveness. This work included primary research at 50 companies (in industries spanning consumer products, energy, life sciences, high technology, and financial services) and extensive secondary research and analysis on innovation successes and failures. It also included a survey of 758 executives from more than 380 companies. And according to our findings, successfully and consistently innovating requires unlearning a number of common behaviours and ways of thinking. Success also requires directly confronting the costs and risks of innovation, and careful consideration of when, and when not, to apply different innovation strategies.

By reframing a false dichotomy between open and proprietary innovation, and rebalancing their focus on organizational culture and people, companies not only increase innovation but, more importantly, also increase competitive advantage and commercial benefit derived from innovation.

Here are nine strategies to maximize revenue returns on innovation investment.

EMBRACE “SMART” FAILURES

The bromide that innovation requires embracing and celebrating failure is widespread but honoured more in the breach than in practice—despite an extensive body of research that supports the important role failure plays in the innovation process. For example, in their 2019 article “The Risk of De-Risking Innovation,” Donald Drakeman and Nektarios Oraiopoulos make a compelling case that because “fast and frequent failures are the precursors of novel products, organizations could benefit by creating mechanisms that encourage them.” Indeed, in our research we found unanimous and strong support from leaders at all levels for the importance of failure in generating innovation. We also found at every company that individuals at all levels felt that failures were usually punished and hardly ever celebrated or rewarded. What explains the dissonance?

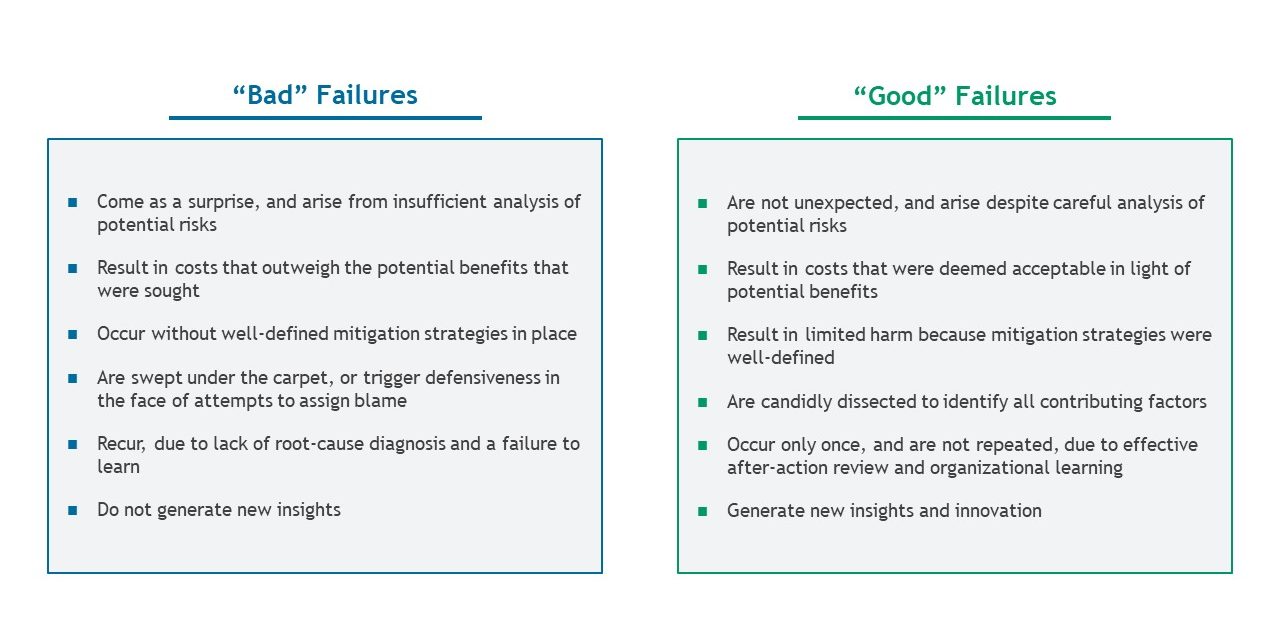

The reality is that many failures do not contribute to innovation, and rightly deserve censure, not celebration. Think of the Challenger space shuttle disaster. No organization, and no leader, can follow a general precept of celebrating failures. Unless a clear distinction is made between productive and wasteful failures and is effectively communicated throughout an organization, people will notice, and focus too much on, apparent inconsistencies when failure is punished. Carefully articulating what makes a failure worthy of praise and reward, and what constitutes the kind of failure that will be criticized and penalized, is an essential task for leaders in any organization that wants to motivate the kind of experimentation and risk-taking that innovation requires (see Figure 1 for examples of “good” versus “bad” failures).

FIGURE 1

“Bad” versus “good” failures

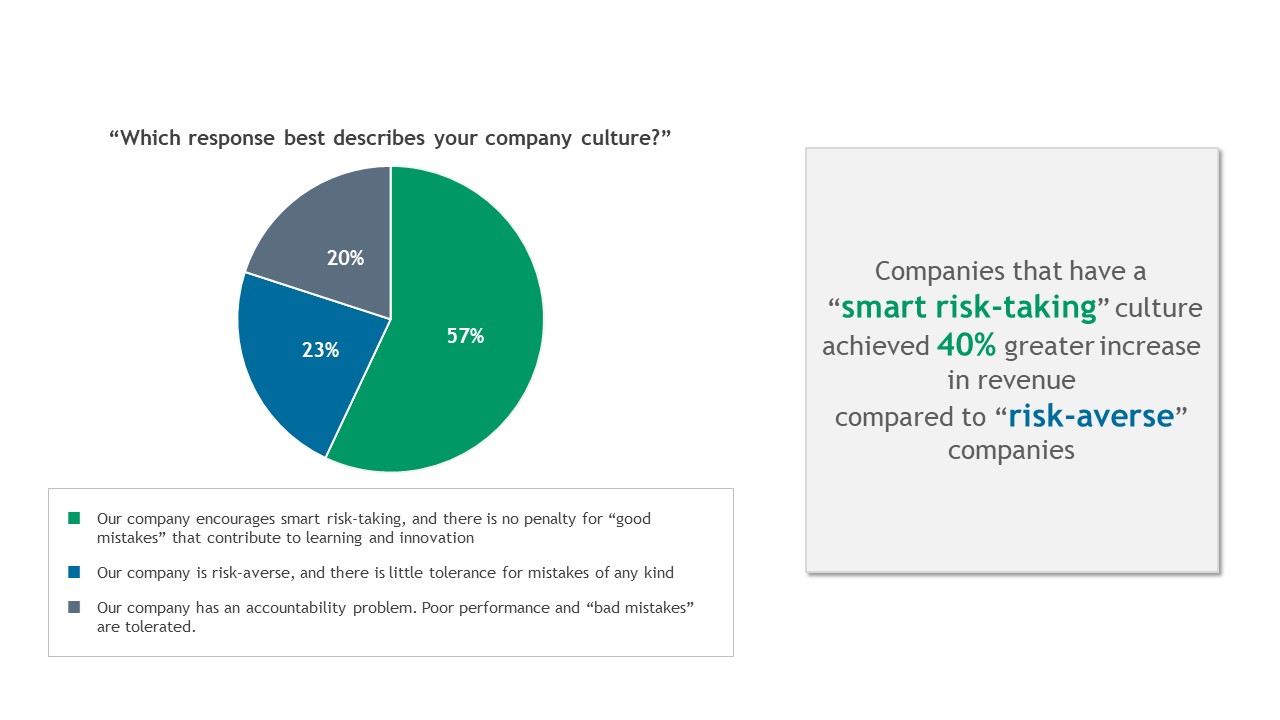

Our research indicates that companies where leaders deliberately cultivate a culture of “smart risk-taking” achieved a 40 per cent increase in revenue compared to companies with risk-averse cultures.

FIGURE 2

Company culture related to risk-taking and “mistakes”

RETHINK “SUCCESS”

A corollary to celebrating and rewarding productive failures is reorienting notions of success. Consider the high-risk/high-cost domain of space exploration. Efforts to develop new, innovative rocket designs have traditionally focused on ensuring “successful” launches. After all, the cost of building an initial prototype, coupled with the further cost of delay if a test mission fails, is (pardon the pun) astronomical. Hence, a rocket exploding is a failure so costly that virtually any effort and expense is justified to avoid it. Boeing has continued this paradigm. SpaceX has followed a completely different approach.

Two days after SpaceX’s SN1 prototype burst apart during a pressure test on February 28, 2020, company CEO and chief engineer Elon Musk posted a video of the explosion, then tweeted, “It’s fine, we’ll just buff it out,” followed by, “Where’s Flextape when you need it?” This insouciance demonstrates a startling comfort with (apparently) costly failures. Coming from an outsized personality like Musk, such comments garner a great deal of attention. But principal integration engineer John Insprucker’s comment, made during a company webcast after SN9 exploded upon impact at landing, is even more revealing: “Again, we’ve just got to work on that landing a little bit. We got a lot of good data, and the primary objective—to demonstrate control of the vehicle in the subsonic re-entry—looked to be very good, and we will take a lot out of that.” This reconceptualization of “success” to be about the value of learning, versus the traditional view of end-to-end perfection, is at the heart of SpaceX’s approach to innovation in an industry that always thought the cost of “failure” required a commitment to total “success.”

PAY ATTENTION TO PEOPLE

Two-thirds of CEOs surveyed by the Korn Ferry Institute in 2016 said they believed technology will create greater value in the future than their workforce will, and 44 per cent believed that automation, artificial intelligence, and robotics will make people “largely irrelevant” in the years to come. We believe this reflects a conflation of cause and effect (and perhaps an infelicitous phrasing of the survey question). New technology continues to deliver enormous benefits to humanity as it has for thousands of years. Someday, artificial intelligence may indeed generate valuable innovations on its own. We are far from that day. Meanwhile, human beings are the source of innovation, and technology is the fruit of human creativity. Human beings are also essential to the effective deployment and use of new technology.

The innovation journey that led from the Sony Walkman to the Zune to the iPod and to the iPhone was one of human ingenuity. The iPod did not create the iPhone. The iPhone resulted from a long chain of innovation involving myriad human beings, and its success in the marketplace required the collective efforts of thousands of individuals in roles spanning finance, marketing, and supply chain management. Harnessing the collective brainpower of the people in an organization leads to faster innovation, better products and services, and more profit. Rapidly evolving technologies like AI and machine learning should be viewed not as replacements for human judgment and creativity, but as ways to enhance human potential.

A fascinating case study of human–machine collaboration occurred at a 2005 “freestyle” chess tournament hosted by Playchess.com. Competing teams could include any combination of human players and computers. One might have expected the winning team to comprise a Grandmaster paired with a state-of-the-art supercomputer. Instead, two American amateurs working with three computers came out on top. Chess legend Gary Kasparov interpreted the result in a 2021 Harvard Business Review article as follows: “Weak human + machine + better process was superior to a strong computer alone and, more remarkably, superior to a strong human + machine + inferior process.”

In 2020, tire manufacturer Yokohama Rubber announced its HAICoLab (which stands for “Humans and AI Collaborate”) platform. According to Masataka Koishi, head of the AI Laboratory at Yokohama Rubber, “It’s a framework that emphasizes collaboration between humans and AI. The ‘HAICoLab loop’ greatly improves the probability of radical innovation, as well as promoting the growth of our engineers.”

A misguided focus on technology as the primary source of a company’s value inevitably leads to an underappreciation of, and underinvestment in, human capital. The average individual worker’s lifetime work today spans 40 to 50 years. According to Forbes, time-to-obsolescence for web-enabled services was three to five years 15 years ago; today, it is just 14 to 18 months. If you do the math, that is 26 to 42 innovation cycles the average worker will go through in their lifetime.

With innovation cycles shortening, so too are the life cycles of companies. Corporations in the S&P 500 Index in 1965 stayed in the index for an average of 33 years. By 1990, the average tenure in the S&P 500 had narrowed to 20 years and it is now forecast to shrink to 14 years by 2026. Meanwhile, human lifespans continue to increase. The average number of jobs in a lifetime is about 12, according to a 2019 United States Bureau of Labor Statistics (BLS) survey of baby boomers. In its 2020 Employee Tenure Summary, the BLS reported that the median employee tenure was 4.3 years for men and 3.9 years for women. The success of an organization is more dependent than ever on its people, and on motivating and enabling them to contribute to continuous innovation.

SOURCE IDEAS, NOT JUST “STUFF”

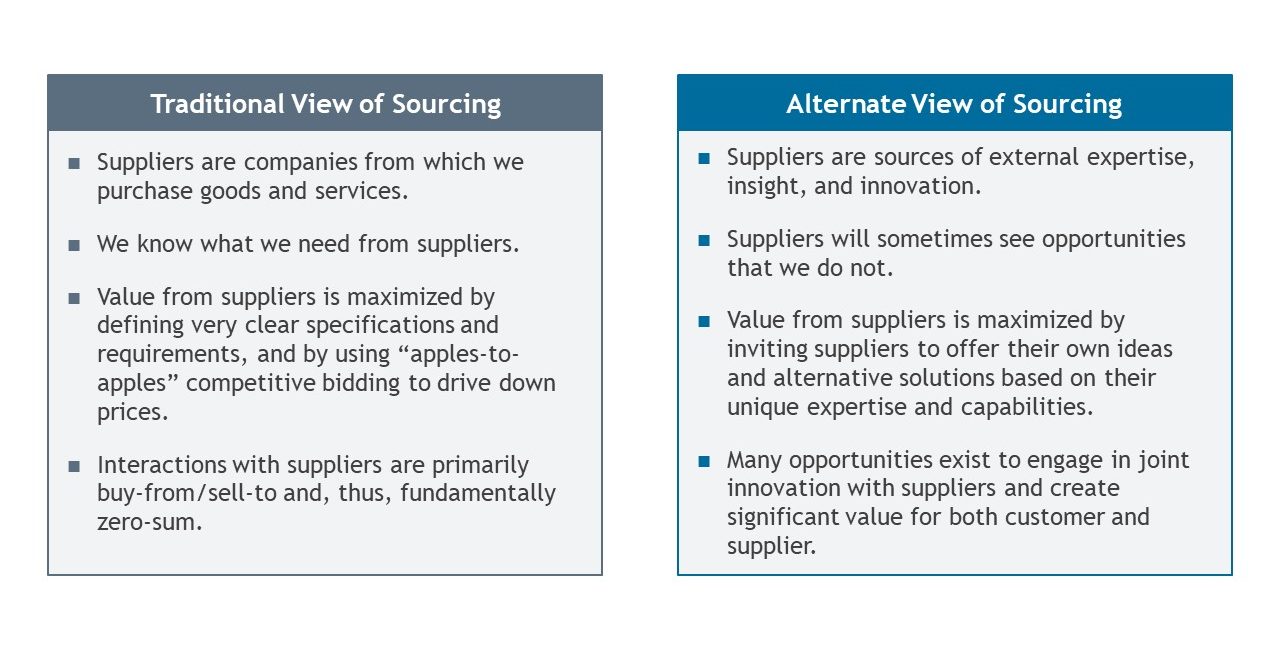

The discipline of strategic sourcing, by now practised in some variation by almost every company, is predicated on an exchange-based model where customers define their needs and pay suppliers to fulfill them. A “best” practice is to define very detailed and tightly defined specifications for those needs, then invite suppliers to provide price quotes and submit proposals explaining their qualifications to deliver on required specifications. There is nothing wrong with this model, and there are indeed many benefits to being clear, internally and with potential suppliers, about exactly what is needed.

The problem is that the standard customer–supplier paradigm stifles rather than catalyzes innovation. Even very small companies often have dozens if not hundreds of suppliers; large companies have thousands. The combined R&D expenditures, patent portfolios, knowledge of marketplace trends, and individual technical expertise across those suppliers dwarf the knowledge assets and innovation capabilities of any single organization. Tapping into the innovation of a company’s supply chain requires a different mindset and different practices. A paradigm shift toward sourcing innovation is required. This shift requires rethinking the traditional relationship between a company and its suppliers.

FIGURE 3

Two views of sourcing

Leveraging traditional practices for sourcing and purchasing external goods and services, and a focus on reducing costs, will always be important. But they must be augmented by new approaches to deepen engagement with select suppliers, create space for them to share creative ideas, and reward them for delivering unique solutions. Even in highly cost-competitive industries, success increasingly comes not from extracting lower prices from suppliers than competitors pay, but by ensuring that a company gets a disproportionate share of suppliers’ best talent, ideas, and investments.

Consider an industrial company we worked with, where regular maintenance of chemical manufacturing and storage tanks constituted a major expenditure with suppliers. Historically, the company sourced carefully specified services, including the setting up of scaffolding for maintenance workers, cleaning and maintenance activities, and the breakdown and removal of scaffolding once complete. What happened when they began to source innovation? They engaged suppliers without providing detailed requirements. Instead, they shared—under confidentiality agreements—different information with potential suppliers than they had ever shared before: about their business model, manufacturing processes, and production schedules and bottlenecks. They then asked their suppliers for new and better ways to maximize production up-time and reduce operating costs.

Most suppliers offered proposals and bids similar to those they had provided in the past. But one supplier noted that it was prototyping a new portable elevator system and offered that this might eliminate the need for scaffolding set-up and breakdown. The supplier’s bid was more expensive—but it reduced maintenance time (and thus lost production time) from weeks to days. The increase in revenue made up for the increased cost many times over.

SHARE, DON’T HOARD

Winning the innovation game requires more than developing innovative offerings for the marketplace, it also requires determining how to maximize the revenue and profit from such innovation. This in turn requires rethinking the costs and benefits of different strategies for “protecting” intellectual property, trade secrets, and other forms of innovation. The exclusive ability to produce and sell innovative products or services is valuable; it creates pricing power and delays commodification. But no innovation is valuable forever. Innovations age out, as new innovations render prior ones obsolete. Focusing on this reality is the first step in assessing how to maximize the value realized from innovation.

Consider a well-known financial services company that had developed a highly differentiated verification solution based on a unique data asset. The president of the business unit that had developed this solution believed that offering it to competitors to resell was the best way to maximize the speed and breadth of marketplace adoption, and thus maximize financial returns for the company and its shareholders. Most other senior executives were aghast. “We can’t possibly share our most innovative product with our competitors. We will enable their success by cannibalizing our own sales! We need to fully leverage the power we have from this solution to drive sales of our other, less differentiated offerings.” The small contingent in favour of a relatively open distribution model pointed out that holding their unique verification solution hostage, as a way to motivate customers to buy other solutions from the company versus its competitors, smacked of extortion. “We might gain some additional sales by forcing some customers to buy X from us when they would rather buy X from a competitor, because only we can sell them Y, but that will certainly generate resentment and ill will. Customers will look for every opportunity in the future to move away from us.”

Extensive debate and analysis led the company to flip the competitive paradigm on its head. By giving competitors access to resell its verification solution, the company confronted them with a choice: invest heavily to develop a competitive solution (with high uncertainty about success) or generate substantial immediate profit at zero risk by acting as sales channel partners. At the same time, the company could leverage the sales forces and market penetration of competitors in order to deliver its innovation to more customers, faster, and maximize market penetration. Meanwhile, competition would continue unabated in the marketplace for many other solutions. But at least for a time, an innovative verification tool would be broadly distributed by competitors, benefiting the company, its competitors, and all their customers.

By creating a reseller pricing structure that optimized benefit for the company while creating sufficient value for competitors, the company was able to maximize the value of its innovation. In the five years following the company’s shift in strategy, revenue from the solution increased 149 per cent, versus a 46 per cent increase in revenue during the preceding five-year period, during which the company did not enable third-party sales and distribution.

This situation highlights another innovation paradox we have observed in numerous situations. On the one hand it is natural, and not altogether wrong, to try to protect innovations. Companies that invest in innovation need to earn an attractive return on those efforts. If a company represents the only route to access the innovation, then it not only reaps all returns, it also limits price competition and reduces the risk of rapid commodification. But in most situations, enabling (some) other companies to market and distribute an innovation not only is a faster path to market adoption—it also means broader penetration of the market than a single company can ever achieve on its own.

But surely it’s self-defeating to share innovation with direct competitors—despite the benefits of distributing innovations through channel partners, resellers, or perhaps embedding innovative technology or features as part of another company’s products?

In their 2019 article “Managing Knowledge Sharing-Protecting Tensions,” Audrey Rouyre and Anne-Sophie Fernandez argue that sharing knowledge with your competitors “[exposes a company] to high risks of knowledge leakage, opportunism, and unwanted spillovers. The knowledge shared within a common project can be used by one competitor against another and can damage firm competitiveness.” Too often, this is the mindset that wins out as executives debate strategies for monetizing innovation, as in the verification solution example recounted above. Usually overlooked is the fact that enabling competitors to benefit by selling or otherwise distributing that innovation greatly reduces their incentive to invest in further competitive innovation.

In other words, by sharing innovations with competitors, companies are likely to extend the effective lifetime of the innovations they develop, and thus their total profits.

COLLABORATE WITH COMPETITORS

The notion of coopetition—collaborating with competitors—was popularized by a 1996 book by Yale School of Management Professor Barry Nalebuff and NYU Stern School of Business Professor Adam Brandenburger. Twenty-five years later, this practice remains relatively rare. “It is still often seen as a last resort,” Brandenberger noted recently. This is consistent with our research and experience. The refrain “We can’t possibly do that—we’d be enabling a competitor!” is pervasive, and substantially limits collaborative innovation with competitive companies.

Innovation ROI equation (Vc) × (Nc) × (Trv)

The value realized in the marketplace from an innovation is the revenue/profit captured from each customer, multiplied by the number of customers from which that value is captured, multiplied by the time for repeated value capture from the same customers (through repeat purchases, subscription pricing, etc.). To maximize innovation using this basic equation, companies must analyze each of these three variables in depth under different scenarios. For example:

-How much less value will the company capture when a customer purchases its innovation from a third party, versus when it sells and delivers that innovation directly to a customer?

-How many sales—which the company otherwise would have made—will be lost to cannibalization by third parties?

-How many more customers would pay for the innovation, over any defined time frame, if it were available from third parties instead of only from the company that developed it?

-How quickly and by how much will the value of the innovation diminish if competitors are not enabled to gain value from it through reselling or distribution partnerships—and thus they opt to invest (more, and sooner) in developing competing innovations?

Part of the problem is that competition between companies is too often viewed as zero-sum. If we assume anything that benefits a competitor will harm us, and allow fear or frustration to shape our thinking, we blind ourselves to a wide array of scenarios where collaboration with competitors can deliver mutual benefit. Alternatively, if we embrace constant and ever-shifting currents of competition as a catalyst to improve and innovate, we expand our strategic options and agility.

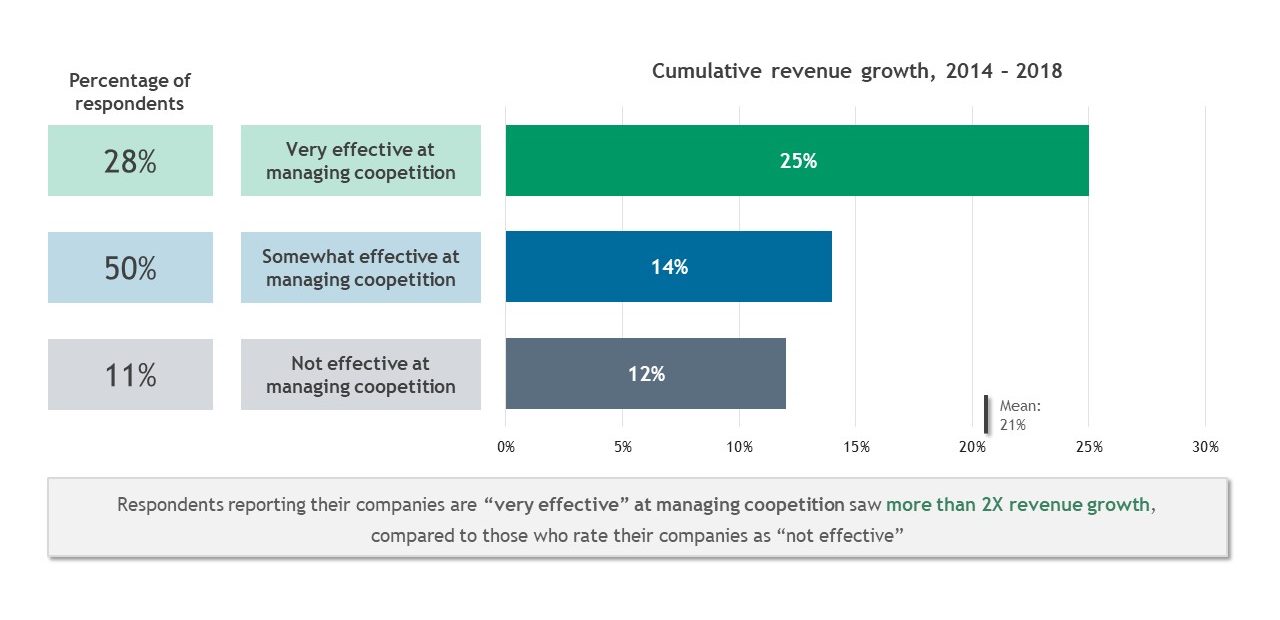

Another challenge is that managing coopetition is just plain hard. Only 28 per cent of participants in our research rated their company as highly effective at managing coopetition. Even among those that expect collaboration with external partners to drive more than 75 per cent of their future growth, 69 per cent of respondents still rated their company as only somewhat effective or not effective at managing coopetition—even though they expected significant competition with many partners. The expectation of heavy reliance on external partnerships, including with competitors, and thus presumably a significant motivation to figure out how to do it well, is not sufficient to ensure effective management of coopetition.

Yet some companies do report being highly effective at managing coopetition, and their financial performance indicates they are onto something. Companies that reported the most extensive use of partnerships with competitors to address competitive threats saw the value of their stock increase by 24 per cent during the prior four years (more than twice the average of all companies in our study). Respondents reporting that their companies are “very effective” at managing coopetition (at collaborating with other companies while also competing with them) saw twice the revenue growth compared to those who rated their companies as “not effective.”

FIGURE 4

Effectiveness managing coopetition has a direct impact on revenue growth

Successful companies employ different models and practices for managing coopetition-based partnerships, but they are united by similar organizational mindsets—as, conversely, are those companies that struggle with coopetition. To a large extent, the difference comes down to those companies that partner with competitors as an absolute last resort, and those that view coopetition as a pervasive feature of business relationships and a challenge to be managed, but not an existential threat to be avoided at all costs.

Our data indicate that the “coopetition-comfortable” companies consistently achieve better results from partnerships with competitors than do “coopetition-averse” companies. In part, this is due to a form of selection bias, but a self-fulfilling one. At companies where coopetition is viewed as highly risky and undesirable, partnerships with competitors are entered into under precisely the conditions where they are least likely to succeed. Extreme pressures have made the near-unthinkable unavoidable. Companies that feel themselves forced into such arrangements are almost always in a severely weakened condition relative not only to the marketplace, but also to their (competitive) partner.

By contrast, coopetition-comfortable companies regularly enter into coopetition-based partnerships not out of desperation, or a position of weakness, but from a position of strength. The marketplace and structural factors surrounding many of these partnerships are more conducive to success from the outset. In the accompanying table (Figure 5), we summarize attitudes about, and approaches to, coopetition that arise from two very different organizational mindsets.

FIGURE 5

Contrasting coopetition mindsets

LOOK OUTSIDE YOUR COMPANY AND YOUR INDUSTRY

Henry Ford got the idea for his revolutionary assembly line after touring a Chicago slaughterhouse. “The fastest way for organizations to make sense of the challenges they are seeing for the first time is to survey unrelated fields for ideas that have been working for a long time,” noted Fast Company magazine co-founder Bill Taylor in a recent article.

Innovation, by definition, entails new and non-obvious solutions to a problem, as well as meeting customer needs that previously were not even recognized. So, it stands to reason that many of the most significant and valuable innovations will come from combining very different perspectives and expertise. That is a major reason why external innovation from collaboration with other companies proves so effective. Moreover, our research suggests that going further, and actively engaging in collaboration with companies in other industries, has the potential to amplify that effect. Yet there are relatively few examples of transformative innovation coming from cross-industry collaboration. To explore why this might be, we took a close look at the bio-pharmaceutical industry.

Pharmaceutical companies have long relied on external collaboration to drive innovation. Large companies (those with annual revenues greater than US$1 billion) accounted for more than 50 per cent of new drugs approved from 2009 to 2021 and an even greater share of revenues, but they have only initiated about 20 per cent of drugs currently in Phase III clinical trials; the rest are the result of the pharmaceutical companies’ collaboration with smaller bio-techs and other external partners.

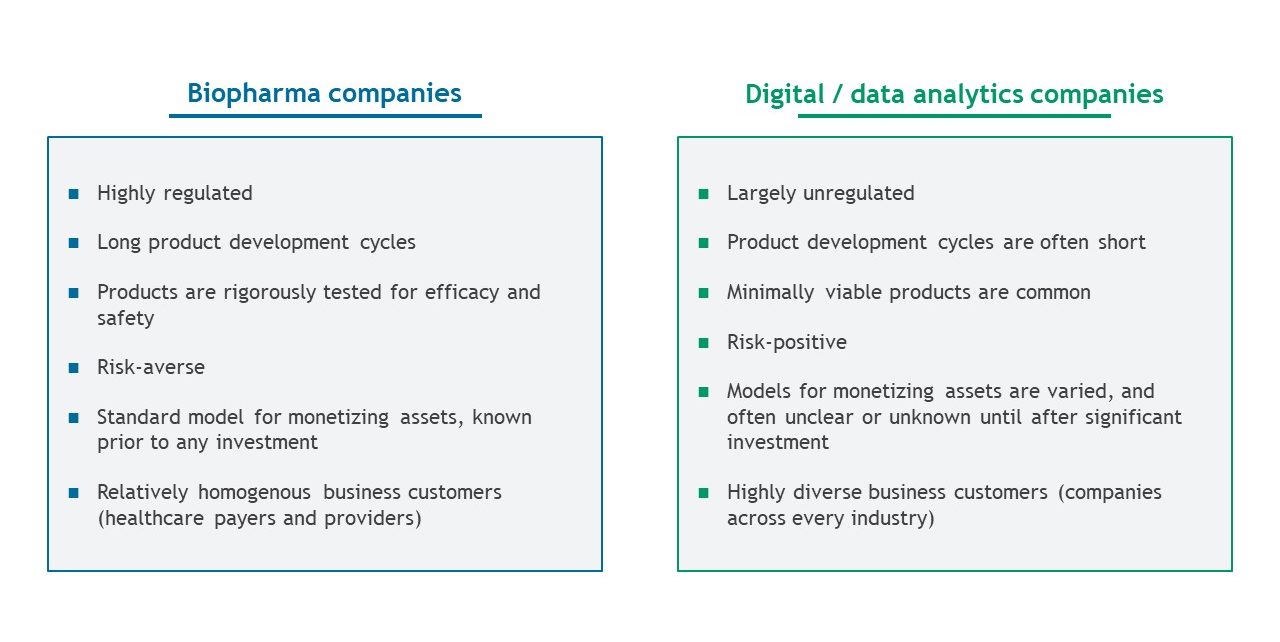

Over the past several years, biopharma companies have increasingly looked outside their own industry, in particular to high-tech companies, to achieve additional innovation. The strategic partnership between GSK and 23andMe is a notable example. This alliance leverages GSK’s expertise in developing and commercializing medicines, combined with 23andMe’s extensive and growing database of genetic and phenotypic data, and its advanced data science skills. But even with the pervasive emphasis on digital transformation in almost every industry, such collaborations still are relatively rare. Key reasons for this are the profound differences between biopharma and high-tech companies, as summarized in the table in Figure 6.

FIGURE 6

Key differences between biopharma and digital companies

The great paradox of cross-industry innovation is this: The very differences that promise breakthrough innovation also make collaboration that much more difficult. As Graham Kenny noted in his article “Dialing Up the Volume on Strategic Innovation,” managers often lack the authority or mandate to step out of their industry box. “Doing what you’ve always done and in accordance with industry standards and expectations is far easier and more comfortable than looking into other industries,” Kenny commented. Harnessing the innovation potential in cross-industry partnerships requires investments to build competencies to navigate and leverage differences—including differing business models; differing organizational operating systems; and the individual expertise and perspectives of senior executives, project managers, and individual contributors.

Despite the difficulties, cross-industry collaboration is on the rise. For example, in 2019, Bristol Myers Squibb (BMS) entered into a US$100 million-plus, multi-year development agreement with ConcertAI to jointly identify new potential indications for BMS’s drug pipeline. ConcertAI, a data and machine learning company, owns significant amounts of patient data and has developed proprietary algorithms to analyze this data. The combination of BMS’s expertise in drug discovery and development and ConcertAI’s data assets and digital technologies holds the promise of breakthrough innovation—more novel therapies developed more quickly and more efficiently than could be accomplished through traditional drug development. Working together in the face of significant differences proved extremely challenging at first, but the alliance is beginning to bear fruit. The two companies have been able to increase the efficiency of pre-clinical research and reduce the time and cost to launch clinical trials through enhanced data analytics and automation.

Another example of expanding innovation horizons beyond industry boundaries is LEGO. For years, LEGO has focused on increasing sales through new product lines that expand its core business and attract new customers. In the case of its Star Wars collaboration, the co-branded product was also parlayed into its own video game series. LEGO’s collaboration model with Disney also covers additional assets like Indiana Jones and Pirates of the Caribbean. Its cross-industry partnership with Nintendo led to the creation of LEGO Super Mario—an innovative combination of physical-world LEGOs that are used to mirror the Super Mario video game, along with a Bluetooth-connected app to enable social gaming. LEGO has also entered into collaborations with IKEA and Adidas to bring crossover products to market. Since 2003, LEGO has increased its revenue 552 per cent, or 33 per cent year over year.

GO BEYOND THE TANGIBLE

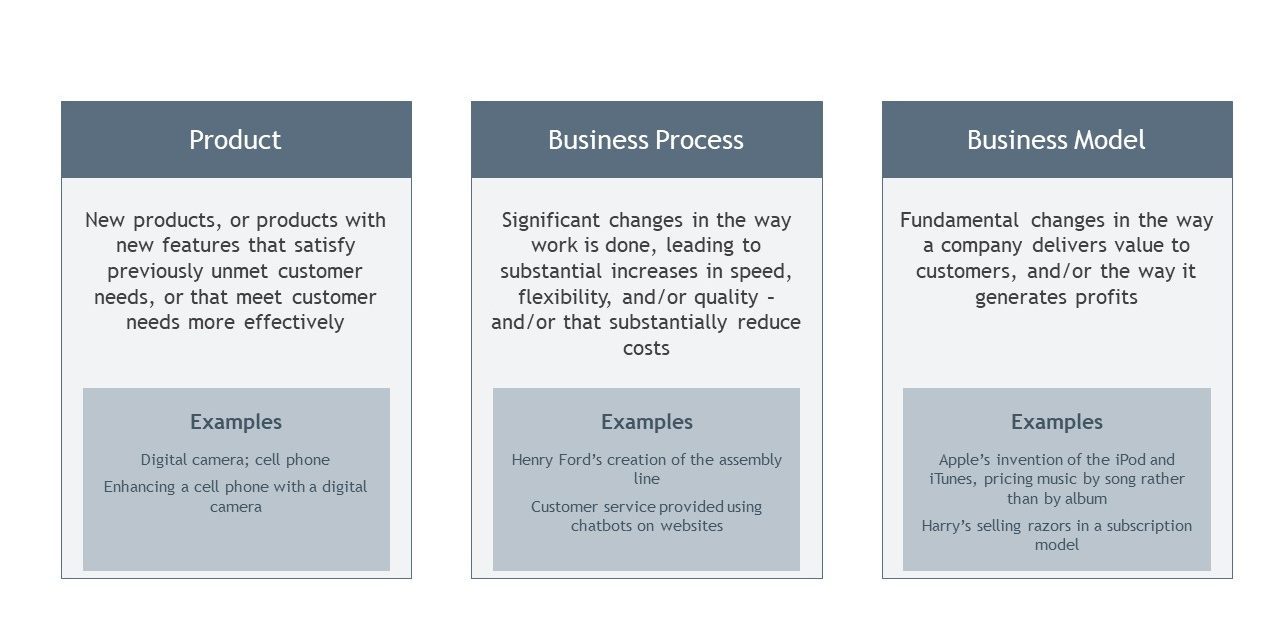

Innovation is, understandably but unhelpfully, associated with tangible artifacts. Think iPhone. But innovations in business processes can have enormous value as well, as in Henry Ford’s novel assembly line production process. Likewise, the development of innovative business models, such as Amazon’s pioneering marketplace business, can be extremely valuable. Or Apple Music—exemplified in the popular imagination by the (now extinct) iPod. But while the iPod was an innovative device that improved in many ways on its predecessors (such as the Sony Walkman), the real innovation was the value proposition Apple offered to music labels and producers, and the intersection of that proposition with affordable consumer pricing by song.

FIGURE 7

Types of innovation

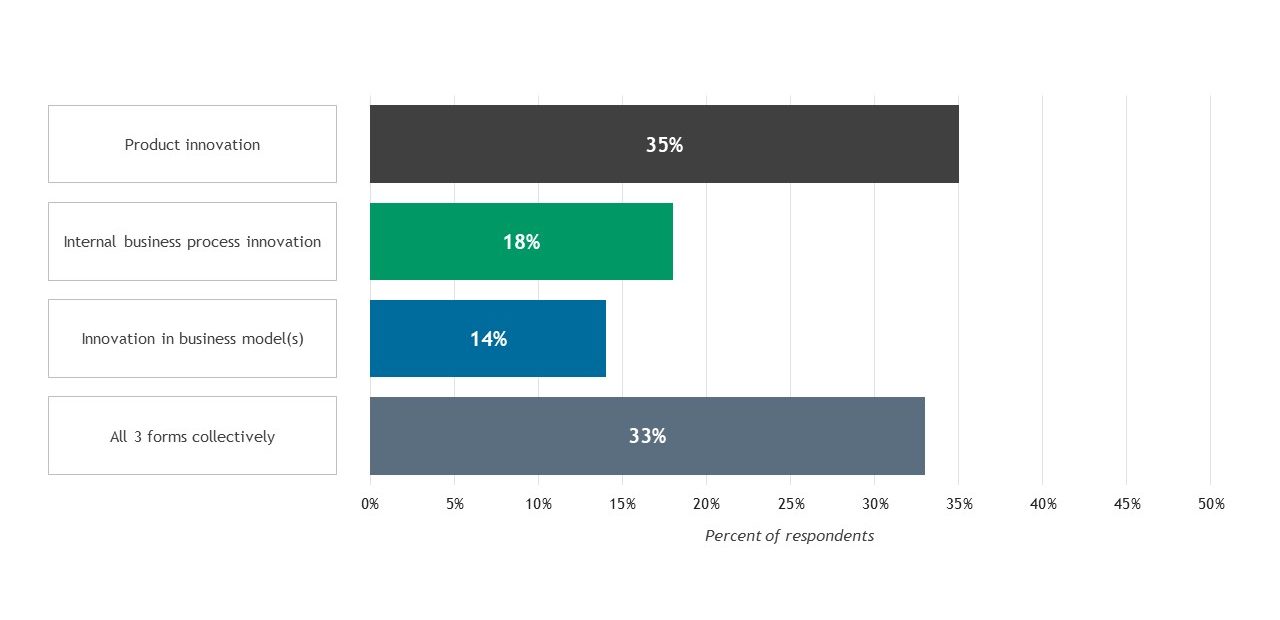

Our research into these different forms of innovation is suggestive rather than conclusive. Interviews and case study analysis, coupled with the survey data shown in the chart below, indicate that more companies focus on product innovation than on innovations to business processes or business models. We believe this accounts for the fact that roughly twice as many companies report realizing more value from product innovation versus innovation focused on business models or business processes.

FIGURE 8

“What form of innovation has delivered the most value to your company over the past five years?”

Interestingly, the relatively small number of companies reporting the most value from business model innovation achieved 119 per cent more revenue growth than the other companies in our dataset, and their stock price increased by 271 per cent more, over the 2014–2018 period.

While participants in our research were most likely to report that product innovation delivered the greatest value, revenue for companies focused on all three forms of innovation (product, business process, and business model) grew 20 per cent more from 2014 to 2018 than revenue for companies focused on product innovation. Product innovation that produces a lasting competitive advantage is increasingly hard to come by. When Apple introduced the iPhone, it was a groundbreaking product. But a mere decade later, hundreds of different smartphones are available, and the iPhone has gone through multiple cycles of incremental innovation. The iPad, the Apple Watch, and AirPods were also quickly copied. Apple has succeeded not so much through “big-bang” product innovation, but rather by running faster innovation cycles than its competitors, and by continuing to combine product innovation with continuous innovation in linked services and business models.

EMPHASIZE EXTERNAL SOURCES OF INNOVATION

An ongoing debate in the literature concerns the relative merits of internal versus externally driven innovation. The Akcigit-Kerr Model, introduced by Ufuk Akcigit and William Kerr in 2015, distinguishes between the two approaches:

- Internal innovation, sometimes called “exploitation” innovation by organizational behavior scholars, concentrates on improvements to a company’s existing product lines, enhancing the capabilities and offerings that the company already has to increase profits.

- External innovation, sometimes referred to as “exploration” innovation, focuses on creating new ideas to add to the company’s product range.

Companies can harness external assets in various ways—in-licencing new technologies, for example, or investing in or acquiring innovative start-ups (Cisco is noted for its serial success at the latter practice). Companies also can combine expertise and resources to pursue innovation through collaborations. As one example, “Tencent has expanded its partnership with JD.com step by step, beginning with an equity investment, moving into data sharing for better customer insight, and then making joint investments totaling more than $6 billion in e-tailor VIPshop and mall operator Wanda Commercial,” note David Harding and Andrew Schwedel in Harvard Business Review.

P&G is a classic case study in the benefits of pursuing external innovation. In 2000, only 15 per cent of P&G’s innovation projects met profit and revenue targets. By 2011, 10 years after the launch of the company’s external innovation program, Connect + Develop, that number was 50 per cent. By 2016, 35 per cent of products originated outside of P&G. Since 2000, P&G’s stock price has increased by 255 per cent—19 per cent and 54 per cent more than its peers Unilever and Colgate, respectively.

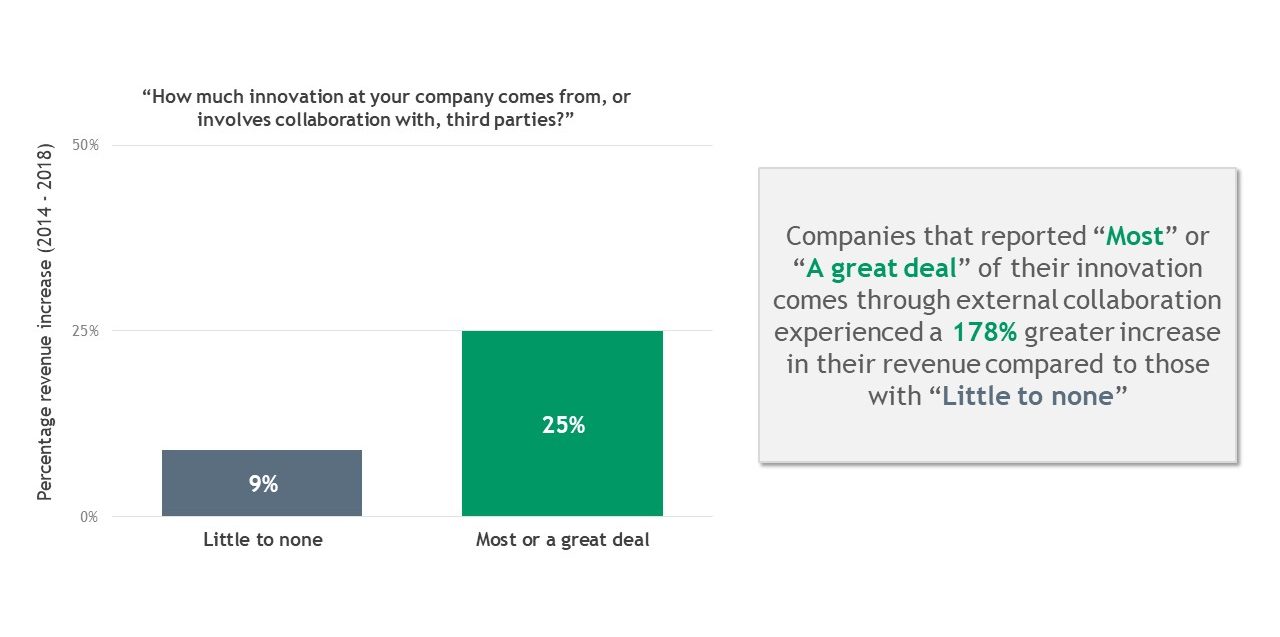

On the other hand, in their article “Why Innovation’s Future Isn’t (Just) Open,” Neil C. Thompson, Didier Bonnet, and Yun Ye argue that “internal innovation may be even more critical [than external innovation] because it offers the possibility of differentiation [and] it helps maintain trade secrets and protect intellectual property.” As noted above, we believe that thinking and practice related to the protection of intellectual property is often counterproductive. And while our research supports the need for both internal and external innovation, it also suggests a substantial benefit from a primary focus on externally driven innovation. Companies in our dataset that emphasized external innovation significantly outperformed those that relied primarily on internal innovation. Companies that reported that “most” or “a great deal” of their innovation comes through external collaboration experienced a 178 per cent greater increase in their revenue from 2014 to 2018 compared to those who reported relying “little to none” on external sources.

FIGURE 9

Revenue change of companies by level of external innovation

General Electric (GE) offers a cautionary case study in the dangers of overreliance on internal capabilities to drive innovation. In 2015, the company embarked on an ambitious plan for digital transformation by establishing GE Digital, a standalone business unit with the goal of driving US$20 billion in sales by 2020 through transformation of the internet of things. GE invested US$4 billion-plus in the development of analytics and its Predix platform, which is designed to help customers collect and analyze data to manage equipment. By 2020, GE Digital was not on track to hit even a significantly reduced target of US$12 billion in revenue. After five years, the Predix platform had never been profitable, and key parts of the digital business were put up for sale as GE refocused on its core power and aviation businesses. GE tried to develop innovative solutions very different from its historical business—but without help from outside its own walls.

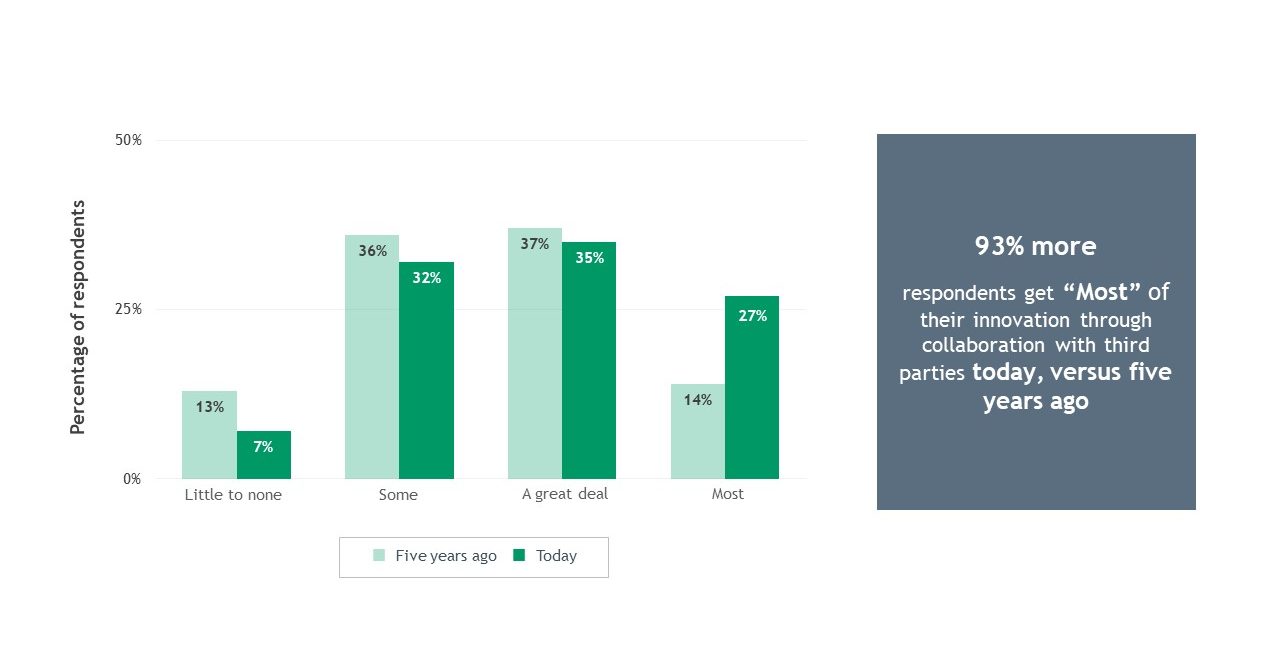

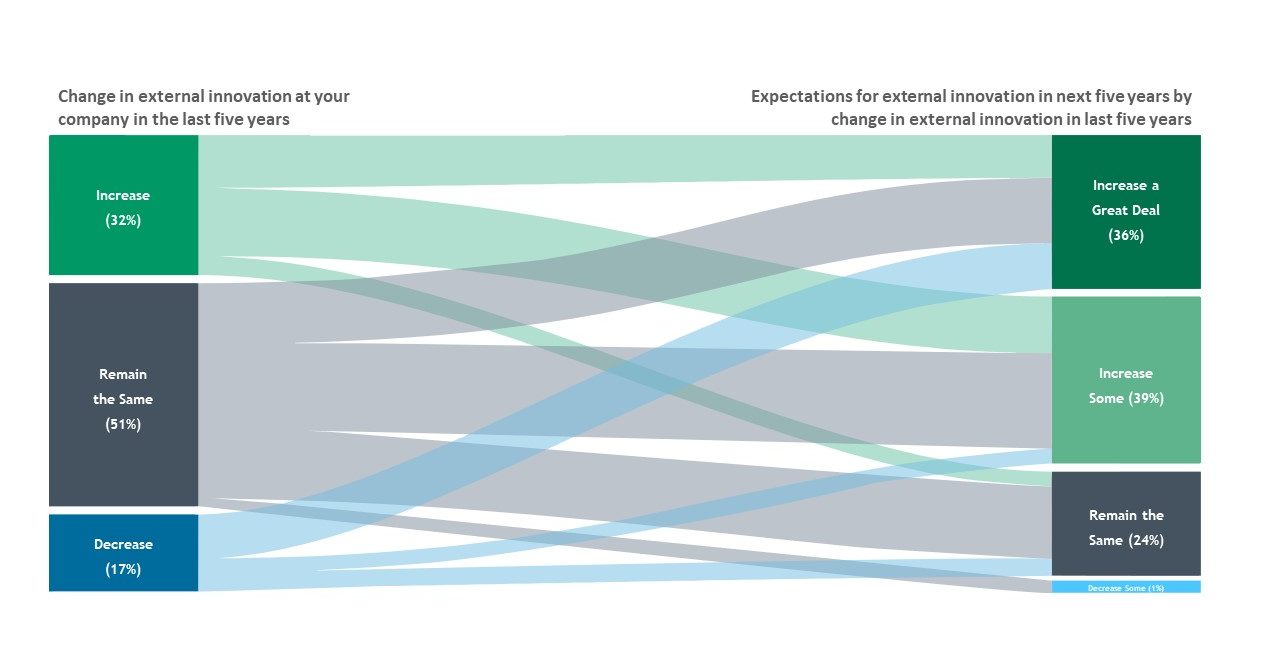

Our research shows an accelerating trend of companies sourcing innovation externally. Based on our study, 93 per cent more companies get “most” of their innovation through external sources today compared to five years ago. Looking to the future, 75 per cent of respondents report that they expect externally sourced innovation within their companies to increase over the next five years.

FIGURE 10

External innovation today versus five years ago

FIGURE 11

External innovation expected to rise in next five years

regardless of recent changes in external innovation

Innovation failures are more than failures to invent the next new thing, be that a product or a business model. GE is number eight on the list of total patents held by a company, but this was not sufficient to stem a rapid decline in its fortunes over the past 10 years. Successful innovation requires companies to look outside their own walls, and even outside their own industries. It requires rethinking the risks and benefits of collaborating with other companies—even competitors. Innovation not only requires embracing risk and accepting failure, but also rethinking ingrained assumptions about what “success” and “failure” mean. Failing to innovate carries a high cost. Even as the market reallocates capital to more productive uses and creates new jobs to replace lost jobs, individual workers and savers incur enormous pain in the process. The stunningly rapid demise of companies like Research in Motion and Blockbuster Video are two of myriad examples. Leaders owe it to both their employees and their shareholders to up their innovation game.

CITATIONS

D. Drakeman and N. Oraiopoulos, “The Risk of De-Risking Innovation: Optimal R&D Strategies in Ambiguous Environments,” California Management Review 62, no. 3 (2020), https://cmr.berkeley.edu/2020/05/62-3-drakeman.

E. Musk (@elonmusk), Twitter posts, March 2, 2020, https://twitter.com/elonmusk/status/1234397781126778890.

J. Foust, “SpaceX Starship Crashes After Suborbital Flight,” SpaceNews, February 2, 2021, https://spacenews.com/spacex-starship-crashes-after-suborbital-flight.

Korn Ferry, “Korn Ferry Global Study: Majority of CEOs See More Value in Technology Than Their Workforce,” news release, November 17, 2016, https://www.kornferry.com/about-us/press/korn-ferry-global-study-majority-of-ceos-see-more-value-in-technology-than-their-workforce#.

D. De Cremer and G. Kasparov, “AI Should Augment Human Intelligence, Not Replace It,” Harvard Business Review, March 18, 2021, https://hbr.org/2021/03/ai-should-augment-human-intelligence-not-replace-it.

“Human–AI Collaboration Inspires Tyre Innovation,” Nature Portfolio, https://www.nature.com/articles/d42473-021-00168-6.

L. Gersh, “The Velocity of Obsolescence,” Forbes, July 29, 2013, https://www.forbes.com/sites/lewisgersh/2013/07/29/the-velocity-of-obsolescence/?sh=157ffc3f6596.

“Baby Boomers Born from 1957 to 1964 Held an Average of 12.3 Jobs from Ages 18 to 52,” TED: The Economics Daily, August 27, 2019, www.bls.gov.

“Employee Tenure Summary,” U.S. Bureau of Labor Statistics, September 22, 2020, www.bls.gov.

A. Rouyre and Anne-Sophie Fernandez, “Managing Knowledge Sharing-Protecting Tensions in Coupled Innovation Projects among Several Competitors,” California Management Review 62, no. 1 (2019), https://cmr.berkeley.edu/2020/02/62-1-rouyre.

B. Garrett, “Why Collaborating with Your Competition Can Be a Great Idea,” Forbes, September 19, 2019, https://www.forbes.com/sites/briannegarrett/2019/09/19/why-collaborating-with-your-competition-can-be-a-great-idea.

B. Taylor, “To Find Creative Solutions, Look Outside Your Industry,” Harvard Business Review, February 7, 2022, https://hbr.org/2022/02/to-find-creative-solutions-look-outside-your-industry.

O. Ben-Joseph and N. Frame, “Make, Buy or Partners: Strategic Alliances Continue to Fuel Biopharma Growth,” In Vivo Citeline Commercial, November 3, 2021, https://invivo.citeline.com/IV124921/Make-Buy-Or-Partner-Strategic-Alliances-Continue-To-Fuel-Biopharma-Growth.

G. Kenny, “What Stops Managers from Looking to Other Industries for Inspiration,” Harvard Business Review, March 11, 2022, https://hbr.org/2022/03/what-stops-managers-from-looking-to-other-industries-for-inspiration.

X. Biagini and A. Benini, “How LEGO Is Rebuilding Its World Through Collaborations: An Overview of the Brand’s Strategy,” Bocconi Students Marketing Society, November 21, 2021, accessed July 17, 2022, www.bocconibsms.com .

D. Tighe, “LEGO Group Revenue 2003-2020,” Statista, January 14, 2022, accessed August 4, 2022, www.statista.com.

G. Vroom et al., “Build Back Better,” IESE Business School Insight 156 (2020), accessed August 4, 2022, https://media.iese.edu/research/pdfs/74921.pdf.

Authors’ analysis of Yahoo Finance data.

W. Kerr, “Innovation and Business Growth,” in Designing the Future: Economic, Societal and Political Dimensions of Innovation, ed. Austrian Council for Research and Training Development (Vienna, Austria: Echomedia Buchverlag, 2015): 137–156, https://www.hbs.edu/ris/Publication%20Files/Kerr-Innovation15_439c4e1b-9b5f-4565-8f22-d9ff0acfe260.pdf.

R. Miller, “How Cisco Keeps Its Startup Acquisition Engine Humming,” TechCrunch, August 23, 2021, https://techcrunch.com/2021/08/23/how-cisco-keeps-its-startup-acquisition-engine-humming/.

D. Harding and A. Schwedel, “Why Traditional M&A Is Becoming Less Important,” Harvard Business Review, May 25, 2018, https://hbr.org/2018/05/why-traditional-ma-is-becoming-less-important.\

N. Thompson, D. Bonnet, and Y. Ye, “Why Innovation’s Future Isn’t (Just) Open,” MIT Sloan Management Review, May 11, 2020, https://sloanreview.mit.edu/article/why-innovations-future-isnt-just-open.

“2020 Global 250: The World’s Largest Patent Holders,” IFI Claims Patent Services, accessed August 4, 2022, https://www.ificlaims.com.